1. Introduction

Overview

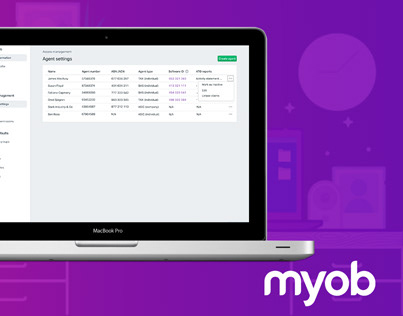

MYOB Practice is a clouded accounting product that allows practices to lodge their tax forms and manage their clients’ base online.

This product plays a big part in the MYOB ‘connected practice’ strategy. This strategy aims at freeing the time of accountants and bookkeepers by automating most, if not all, of their time-consuming daily tasks, such as data entry and client queries.

The ultimate objective is to allow accountants to focus on advisory work and to allocate their time to delivering real-time insights on goal planning and the financial health of businesses, and less on manual tasks.

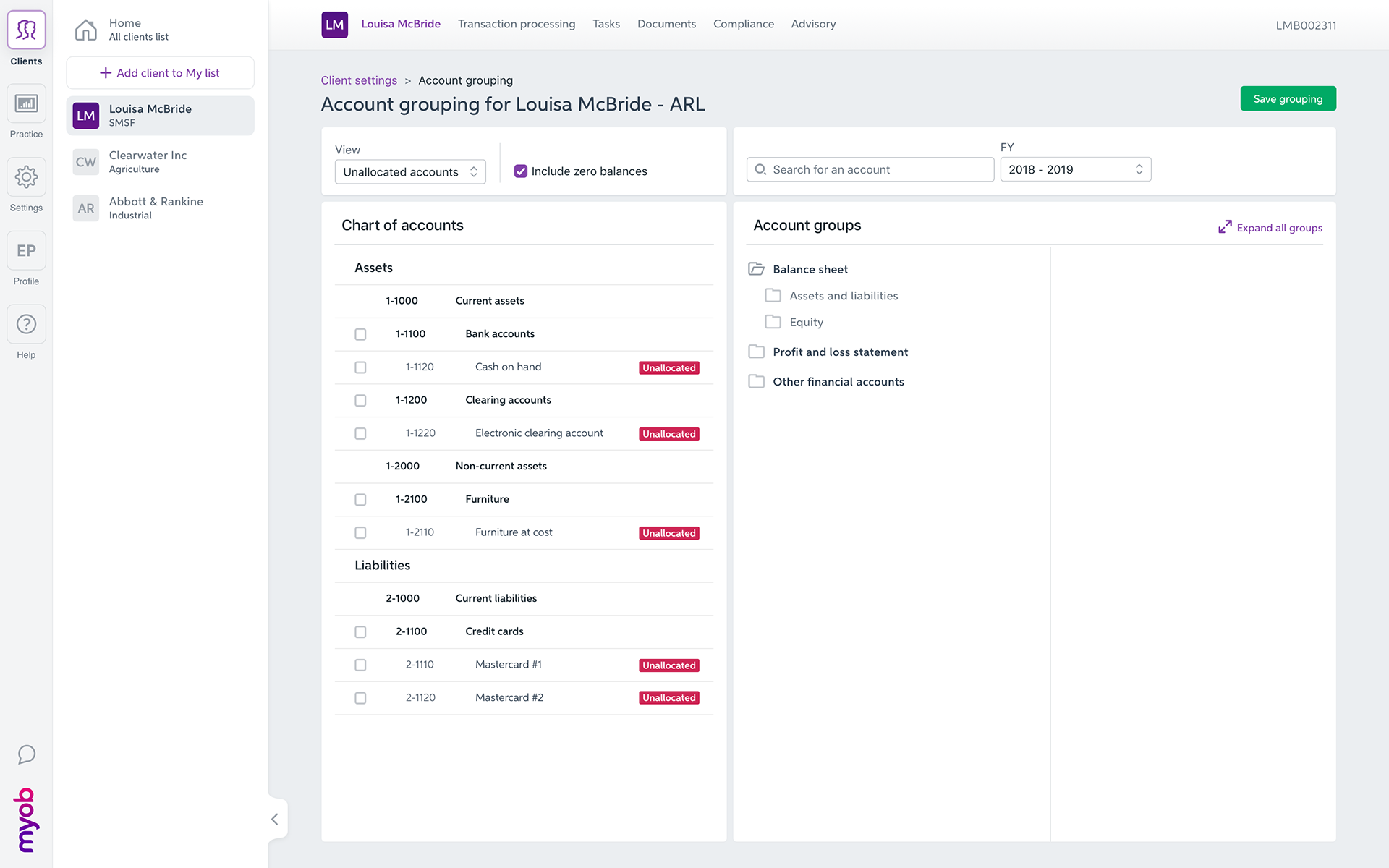

Account Grouping allows us to support multiple different chart of accounts while providing a consistent experience and output for all clients.

For example, account 680 in MAS is bank, 601 in Accounts, 1-1000 in AccountRight.

For example, account 680 in MAS is bank, 601 in Accounts, 1-1000 in AccountRight.

Once you have mapped the accounts from the chart into the account grouping we can populate the compliance workflow easily

Problem statement:

Workpapers, tax forms and financial statements need to display the client’s accounts and balances information. With several variations of charts of accounts, based on product type, entity type, industry sector, and sometimes on practices’ personal preferences. We need to have a standard source of data for all these forms and reports.

Account Groups are collections of standard groupings at various levels (Master, Practice and Client level) to enable auto groupings of accounts according to MYOB standards. Account Grouping will allow any deviation from the safe MYOB defaults to be realigned in order to standardize reporting according to a prescribed industrial representation.

Account Groups will control the order in which account information is displayed on reports and includes control over grouping, sub-headings, sorting, and sub-total. All of these factors should be controlled by the Account Groups alone, and not by the chart of accounts.

User & audience:

Admin

Manager

Practice owner

Practice manager

Senior accoutant

Roles and responsibilities:

The team:

PM - Lisa Miks

BA - Amira Badran

Senior Product Designer - Paul Rodens

Principal Dev - Shane Singh

Development crew - Helios (5 members)

BA - Amira Badran

Senior Product Designer - Paul Rodens

Principal Dev - Shane Singh

Development crew - Helios (5 members)

My Role:

I led the design and the interaction of the agent settings experience between August 2018 and October 2018.

I worked alongside a development team, business analyst, visual designer, UI writers and a Product Manager in order to push this feature to the product.

I worked alongside a development team, business analyst, visual designer, UI writers and a Product Manager in order to push this feature to the product.

This feature has been delivered and is now in product.

Scope and constrains:

High-level requirements:

• Ability for an Accountant in practice to use this

• Allow the user to quickly identify the source and destination through

- Powerful filtering

- Hiding/showing items already grouped

• Indicate conditional grouping (eg: swinging accounts)

• Show hierarchy of Groups (eg: Assets – Current assets – Cash)

• Show which groups and ranges are MYOB Master, Practice, Client specific

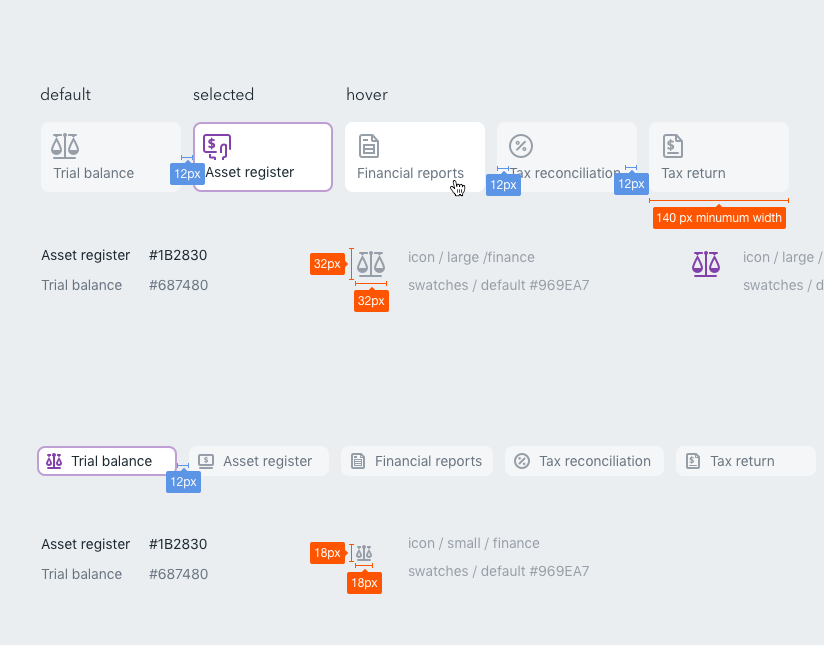

• Easily identify group sets for different report types (eg: Tax/Accounting/Advisory etc)

• Client and Practice level change persist through Master Releases

• Apply Mapping to specific years (Tax and Tax Rec only)

• Flag where accounts are ungrouped/new accounts appear

• Flag where accounts are removed

• Allow for multi selection of accounts – either with for a consecutive range or a set of unrelated accounts - keyboard shortcuts

• We need to be able to deal with the same item appearing in multiple groupings – we want to be able to define this once but have it appear in each set – e.g. Current assets. (Taxonomy)

• Ability to revert Account Grouping to a previous level eg: delete client account group – then reverts to Practice

• Account Group definition and standard mapping should be controlled and definable by a content developer

• Allow the user to quickly identify the source and destination through

- Powerful filtering

- Hiding/showing items already grouped

• Indicate conditional grouping (eg: swinging accounts)

• Show hierarchy of Groups (eg: Assets – Current assets – Cash)

• Show which groups and ranges are MYOB Master, Practice, Client specific

• Easily identify group sets for different report types (eg: Tax/Accounting/Advisory etc)

• Client and Practice level change persist through Master Releases

• Apply Mapping to specific years (Tax and Tax Rec only)

• Flag where accounts are ungrouped/new accounts appear

• Flag where accounts are removed

• Allow for multi selection of accounts – either with for a consecutive range or a set of unrelated accounts - keyboard shortcuts

• We need to be able to deal with the same item appearing in multiple groupings – we want to be able to define this once but have it appear in each set – e.g. Current assets. (Taxonomy)

• Ability to revert Account Grouping to a previous level eg: delete client account group – then reverts to Practice

• Account Group definition and standard mapping should be controlled and definable by a content developer

Constrains:

• Account grouping, already exists in the desktop product but will not be migrating to the online system, the users will then have to duplicate the work if using both environments

• Time was a big constrains, we only 3 months to deliver this entire project

• Account grouping, already exists in the desktop product but will not be migrating to the online system, the users will then have to duplicate the work if using both environments

• Time was a big constrains, we only 3 months to deliver this entire project

2. What happened

the Design Process

2.1 Discover Insights to the problem

The first thing we did was a project ‘kick off’ with the BA, PM and key stakeholders in order to gather insights into the problem, have an understanding of the scope and identify any potentially risky assumptions.

I did several internal listening tours with MYOB accountants and members of the desktop team in order to gather knowledge of the subject and existing implementations.

What did we know?

• Users need to map or group client accounts in order for the data to flow through the relevant parts of the solution.

• The current desktop implementation has duplicated the account grouping functionality for different outputs (or purposes); Tax, accounting and advisory.

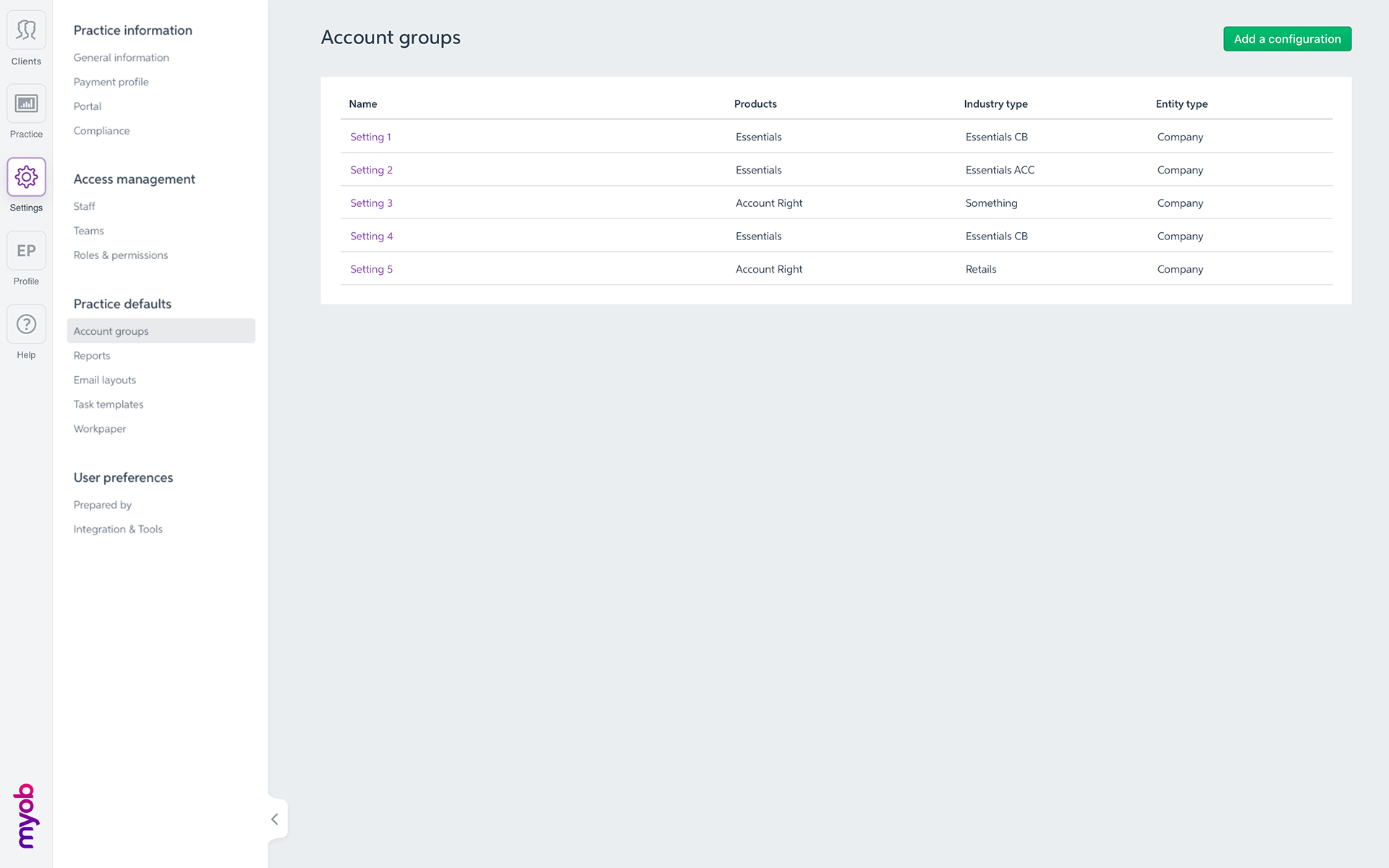

• Practice level settings can be applied for similar clients using the same type of ledgers.

• The current desktop implementation has duplicated the account grouping functionality for different outputs (or purposes); Tax, accounting and advisory.

• Practice level settings can be applied for similar clients using the same type of ledgers.

Our hypothesis

• Adding an account grouping section in the practice settings part of MYOB practice to allow users to manage and group accounts at a practice but also client level.

• Accountants would prefer to have a centralised account grouping function that would cater for Tax, Accounting and Advisory and not having to repeat the process from different places.

• Accountants would want to be able to manage practice but also client level settings.

• Keeping an similar interface to the one of the desktop environment (but remove the clutter) to give the users a sense of familiarity and avoid having to relearn how to group accounts.

• Accountants would prefer to have a centralised account grouping function that would cater for Tax, Accounting and Advisory and not having to repeat the process from different places.

• Accountants would want to be able to manage practice but also client level settings.

• Keeping an similar interface to the one of the desktop environment (but remove the clutter) to give the users a sense of familiarity and avoid having to relearn how to group accounts.

2.2 Define - the are to focus on

What we didn’t know and wanted to discover

• How users are expecting to identify unallocated accounts

• What is their current experience using the desktop product, what do they like, what could / should be improved

• What interactions are users expecting in order to group or map an account to a group; buttons, drag and drop, right click, others ...

• Can user map an account twice, what are the scenarios?

• Are users expect to roll over the settings from the desktop account mapping?

• Are users expecting to be able to "restore" to certain level (practice setting)?

• Are users using the practice defaults or are they doing account grouping on a client by client basis?

• What is their expectations managing credit & debit ranges?

• What is their expectation in therm of saving, manual or autosave?

• What is their expectation "moving" accounts or groups of account from one folder to another?

• What interactions are users expecting in order to group or map an account to a group; buttons, drag and drop, right click, others ...

• Can user map an account twice, what are the scenarios?

• Are users expect to roll over the settings from the desktop account mapping?

• Are users expecting to be able to "restore" to certain level (practice setting)?

• Are users using the practice defaults or are they doing account grouping on a client by client basis?

• What is their expectations managing credit & debit ranges?

• What is their expectation in therm of saving, manual or autosave?

• What is their expectation "moving" accounts or groups of account from one folder to another?

2.3 Develop - potential solution

What was tested?

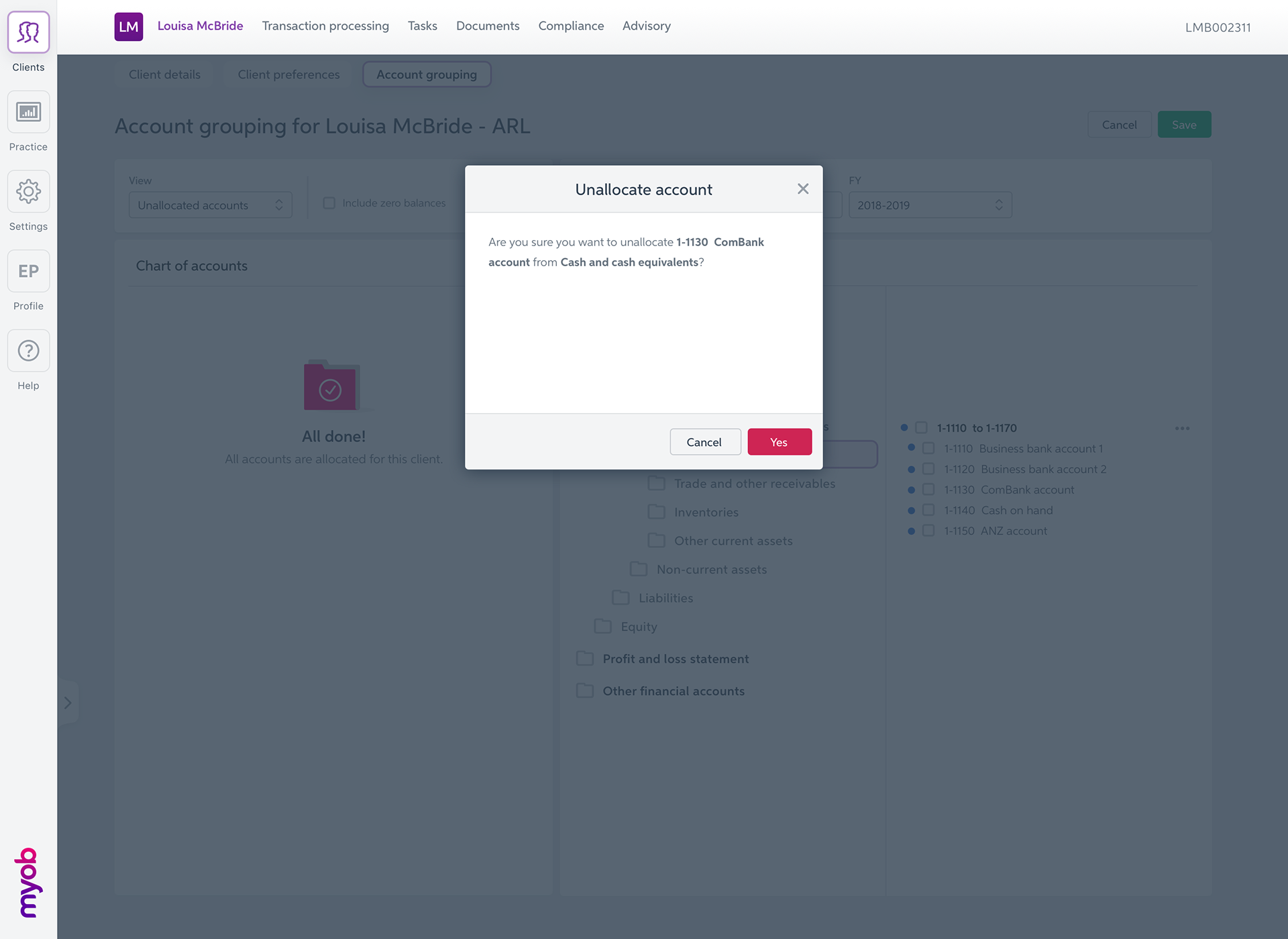

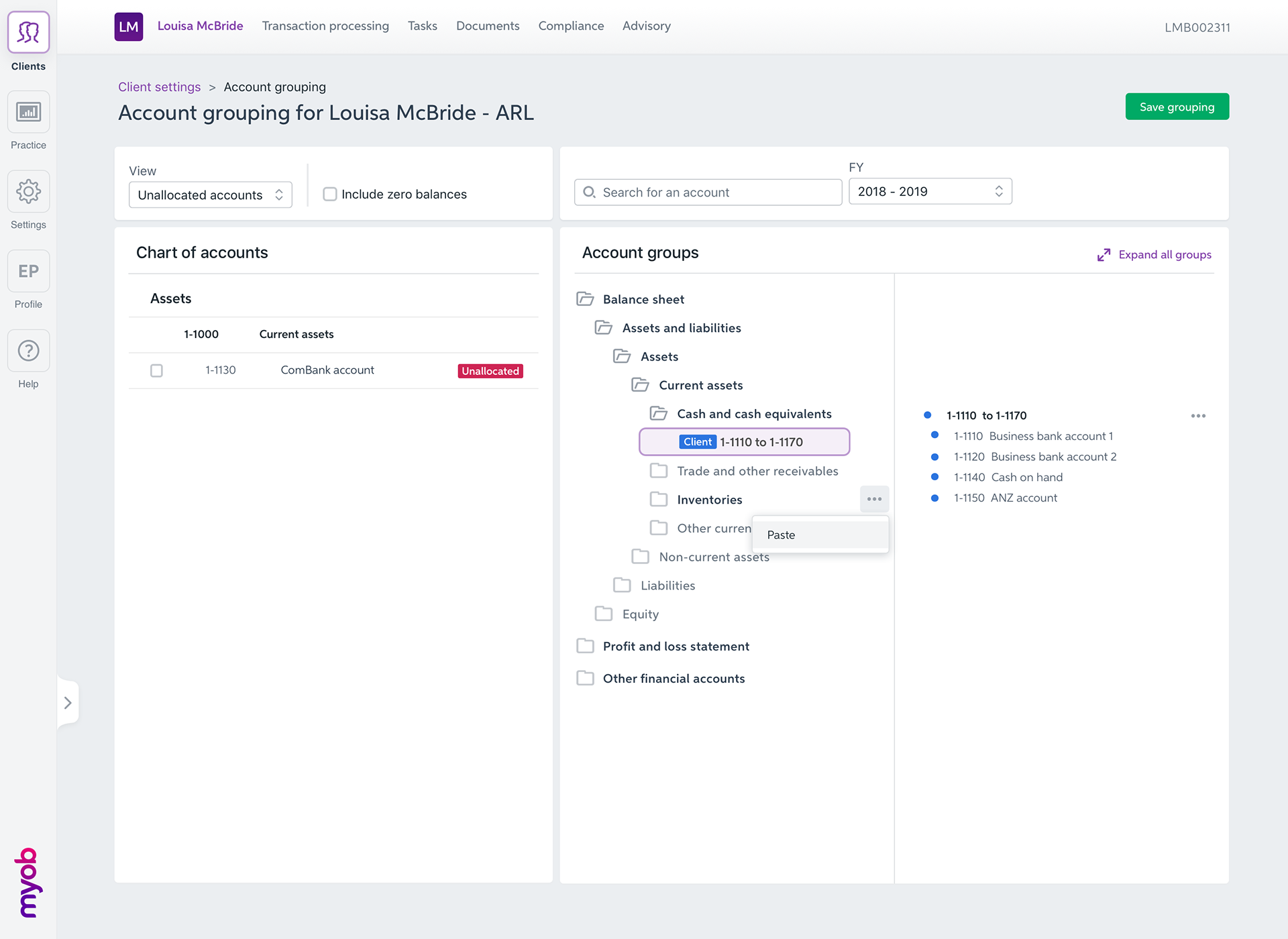

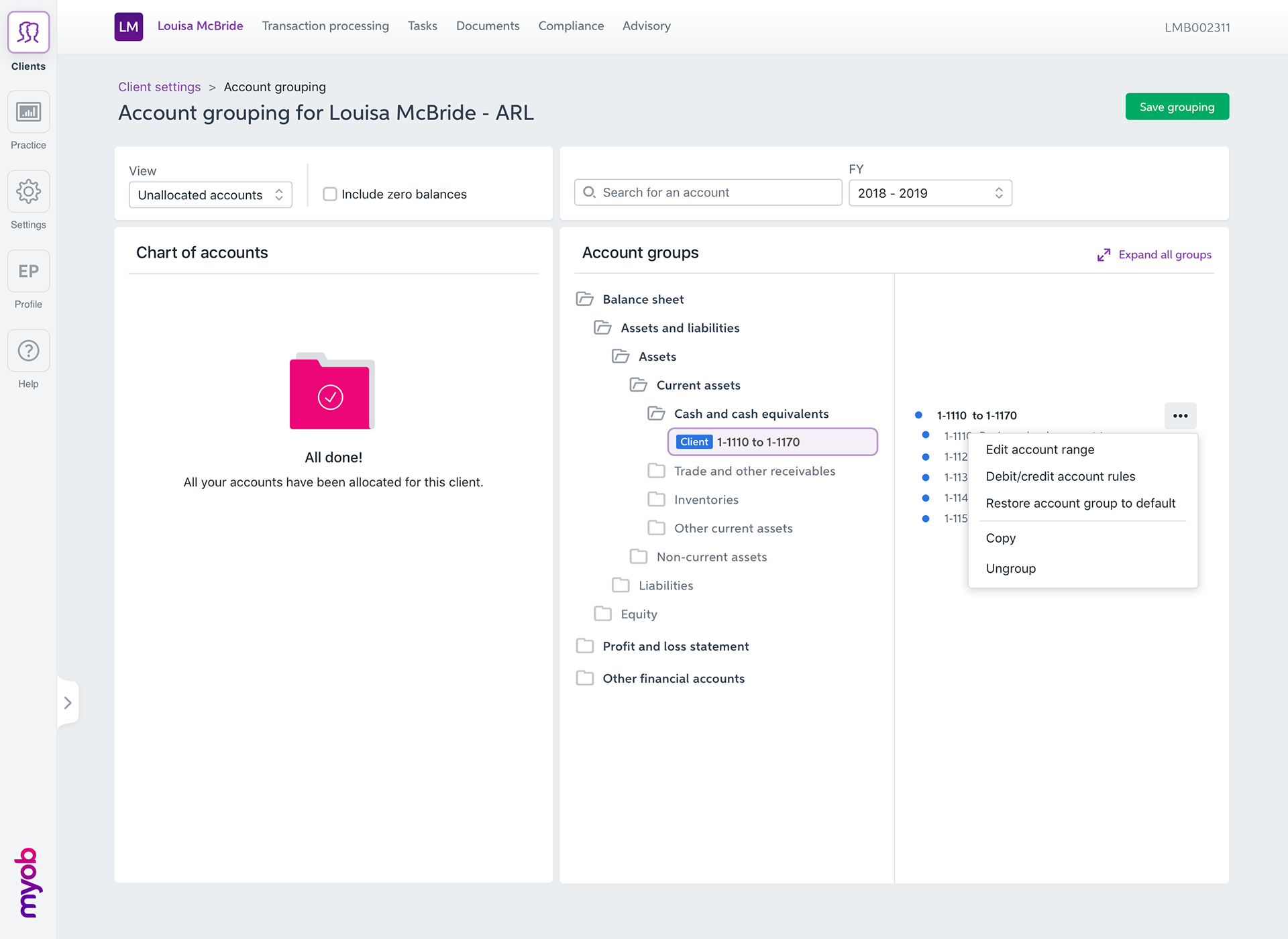

• How would a user find or isolate unallocated accounts?

• How would a user would allocate (or map) and account to a specific group?

• How would a user update an account range?

• How would a user manage credit and debit ranges?

• How would a user delete but also copy and paste a set of accounts?

• How would a user use the search functionality?

• How would a user update an account range?

• How would a user manage credit and debit ranges?

• How would a user delete but also copy and paste a set of accounts?

• How would a user use the search functionality?

Usability testing

• Semi interactive prototypes (done in Sketch and Invision) that allowed testers to perform specific tasks

• High fidelity prototypes (we don’t really do many low fidelity prototypes at MYOB once we go to user testing)

• Interview guide

• Interview guide

What was the result? Highlights?

• All testers successfully retrieved the account grouping functionality in the practice settings

• Because the page hierarchy is inspired by the desktop product, all testers could identify quickly the available features with a certain degree of confidence

• All testers enjoyed the fact that the interfaced was cleaner and easier to use, as we removed a lot of clutter and unnecessary features

• All testers enjoyed the drag and drop function and found it intuitive and appropriate to this function

• Not all testers realised we now are suggesting to consolidate accounting, tax and advisory in one consolidate section

• Not all testers discovered the account grouping at a client level

• All testers are expecting feature to be manually saved, as there could be some trial error involved and they don't want wrong data starting to flow through unwillingly

• All testers responded very well to the "familiar" interface and how it doesn't look to dissimilar to the desktop interface. it helped users to achieve most testing tasks relatively easily and avoided them having to learn a brand new interface

• Because the page hierarchy is inspired by the desktop product, all testers could identify quickly the available features with a certain degree of confidence

• All testers enjoyed the fact that the interfaced was cleaner and easier to use, as we removed a lot of clutter and unnecessary features

• All testers enjoyed the drag and drop function and found it intuitive and appropriate to this function

• Not all testers realised we now are suggesting to consolidate accounting, tax and advisory in one consolidate section

• Not all testers discovered the account grouping at a client level

• All testers are expecting feature to be manually saved, as there could be some trial error involved and they don't want wrong data starting to flow through unwillingly

• All testers responded very well to the "familiar" interface and how it doesn't look to dissimilar to the desktop interface. it helped users to achieve most testing tasks relatively easily and avoided them having to learn a brand new interface

2.4 Deliver -Solutions that work

What did I deliver?

What did I deliver?

The findings of the round of user testing was presented to the key stakeholders in a meeting.

Based on these insights, we agreed on the first version, or MVP of account grouping and what needed

to be released for the users to be able to achieve their primary goals.

This was a combined effort with the development team, BA and PM.

Based on these insights, we agreed on the first version, or MVP of account grouping and what needed

to be released for the users to be able to achieve their primary goals.

This was a combined effort with the development team, BA and PM.

I iterated on the designs and delivered a set of interactive prototypes that covered all the use cases we agreed to deliver

for the first cut of this feature.

for the first cut of this feature.

I worked closely with Customer Experience to create and review the copy across the entire delivery.

Some trade offs were made and we had to make some compromises that went against the users’ feedback that we uncovered during the user testings.

What were they?

• Despite users loving the drag and drop feature, this interaction has been de-scoped.

The development estimate in order to achieve this interaction would have cost MYOB an extra sprint of development.

Because this feature is not a frequently used feature, it was the PM's decision not to come back to this and add the interaction at a later date.

The development estimate in order to achieve this interaction would have cost MYOB an extra sprint of development.

Because this feature is not a frequently used feature, it was the PM's decision not to come back to this and add the interaction at a later date.

3. In conclusion

Outcomes and results:

• Overall this was a very successful project.

It was a relatively challenging project as the subject was (and still is) very hard to grasp if you are not an accountant.

It took me a long time before I could get onto the designs themselves, trying to understand the primary objectives of the users when using this feature.

It was a relatively challenging project as the subject was (and still is) very hard to grasp if you are not an accountant.

It took me a long time before I could get onto the designs themselves, trying to understand the primary objectives of the users when using this feature.

• It was the first time I worked with Amira, as BA and as she had just started at MYOB, she was equally trying to find her feed in a new team and in a new organisation. We both at to work at understand each other and how our skill could complement in order to achieve this project successfully

• The amount of features we had to tackle, discover and design for as part of this project where rather substantial and to some respect, it nearly was a waterfall project.

The next time I would hit such a big project with so many deliverables, I would work with my PM and try to break down the scopes into smaller deliverables, easier to manage, test and deliver.

The next time I would hit such a big project with so many deliverables, I would work with my PM and try to break down the scopes into smaller deliverables, easier to manage, test and deliver.

• Based on more recent experience, I would involve the team a lot more in the research / usability testing process.