1. Introduction

Overview

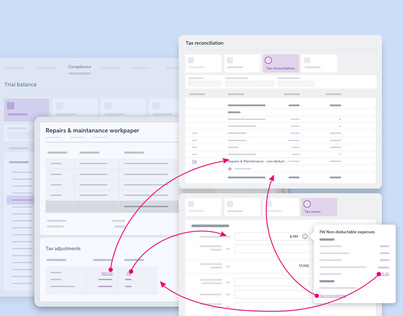

MYOB Practice is a clouded accounting product that allows practices to lodge their tax forms and manage their clients’ base online.

This product plays a big part in the MYOB ‘connected practice’ strategy. This strategy aims at freeing the time of accountants and bookkeepers by automating most, if not all, of their time-consuming daily tasks, such as data entry and client queries.

The ultimate objective is to allow accountants to focus on advisory work and to allocate their time to delivering real-time insights on goal planning and the financial health of businesses, and less on manual tasks.

In order to lodge any compliance job (e.g. BAS, individual tax return) any bookkeeper or accountant needs to be registered to the ATO as either a BAS or a Tax agent.

The system needs to cater for this requirement and allow a practice to create, manage agent settings and also link clients to these relevant agents in within an accounting practice.

Problem statement:

It must be possible for the MYOB practice users to add tax agent settings for compliance and to associate the agent

and the client so that the compliance forms can be lodged with the ATO.

and the client so that the compliance forms can be lodged with the ATO.

Without this feature, the practice cannot legally lodge any tax forms for their clients.

User & audience:

Admin

Manager

Practice owner

Practice manager

Senior accoutant

Roles and responsibilities:

The team:

PM - Tobi Heskett

BA - Bharan Manivannan

Senior Product Designer - Paul Rodens

Principal Dev - Wael Emara

Development crew - Spectrum (5 members)

BA - Bharan Manivannan

Senior Product Designer - Paul Rodens

Principal Dev - Wael Emara

Development crew - Spectrum (5 members)

My Role:

I led the design and the interaction of the agent settings experience between April 2019 and June 2019.

I worked alongside a development team, business analyst, visual designer, UI writers and a Product Manager in order to push this feature to the product.

I worked alongside a development team, business analyst, visual designer, UI writers and a Product Manager in order to push this feature to the product.

This feature has been delivered and is now in product.

Scope and constrains:

High-level requirements:

As an accountant using MYOB Practice I want to be able to manage my agents’ details, client association, and client contact association so that I can lodge my returns online

Constrains:

• An existing list of BAS agents already exists in parts of the product and needed to be consumed and consolidated in one area or the solution

• This level of setting, already exists in the desktop product but will not be migrating to the online system, the users will then have to duplicate the work if using both environments

2. What happened

the Design Process

2.1 Discover - insights to the problem

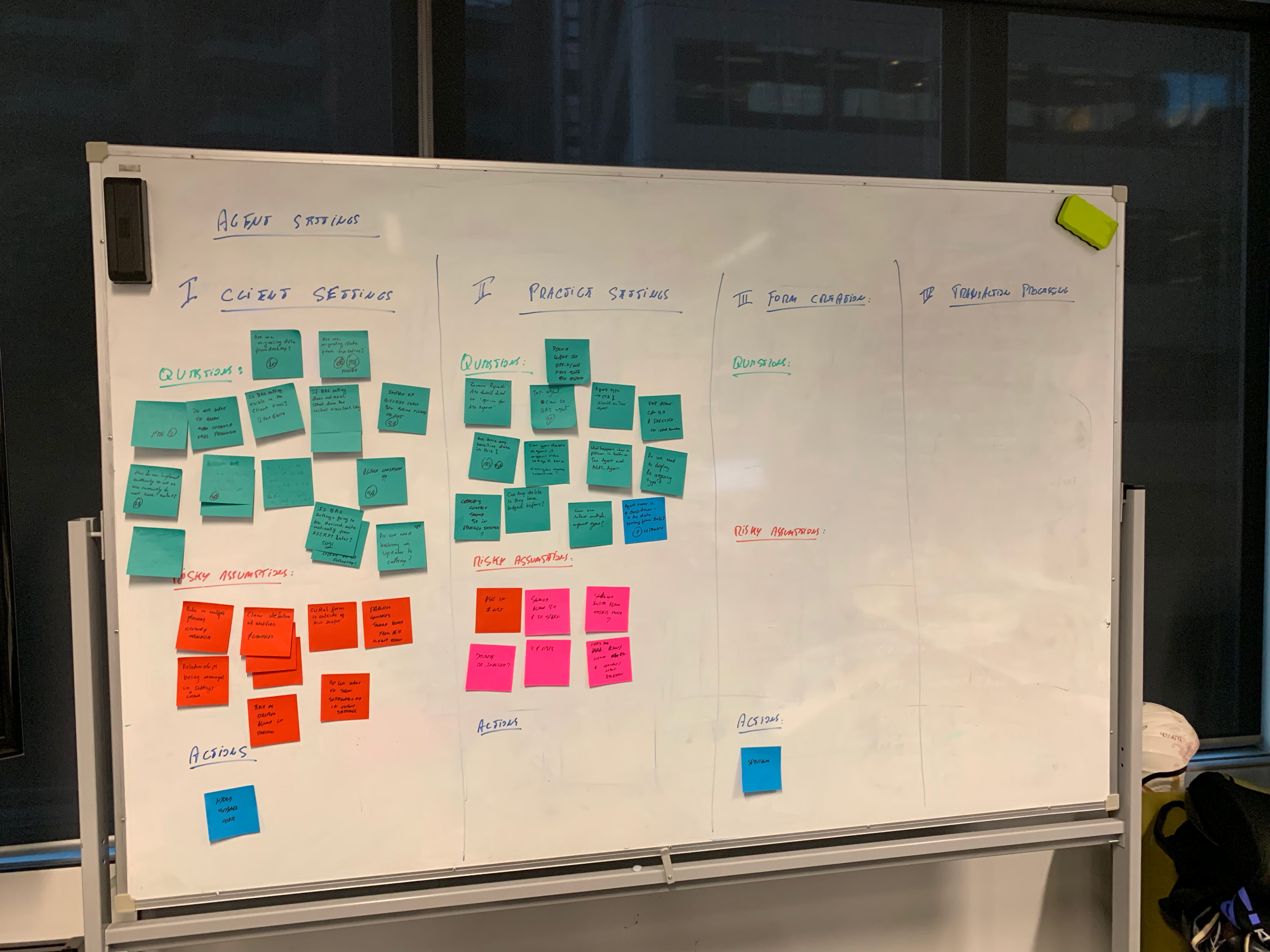

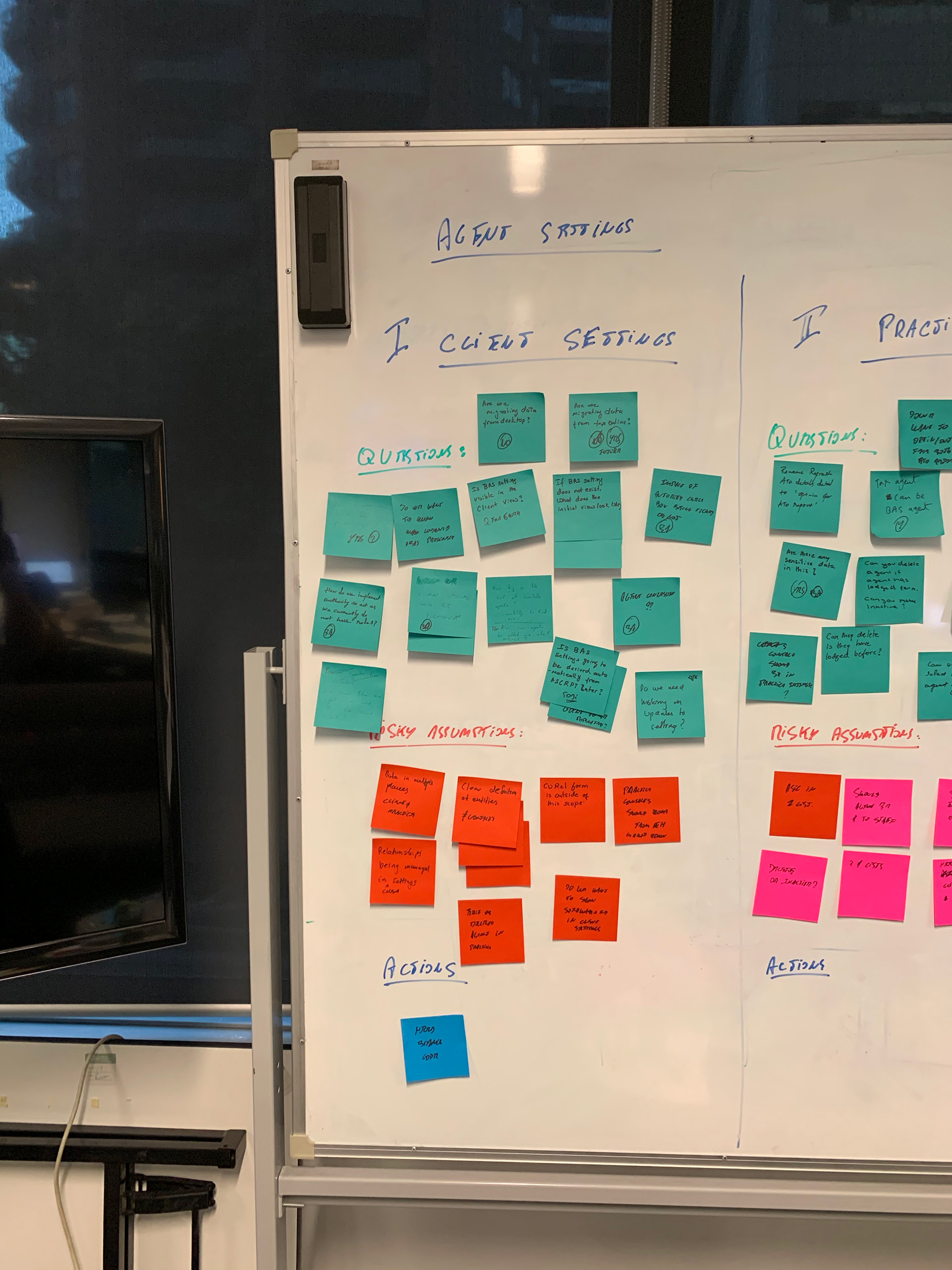

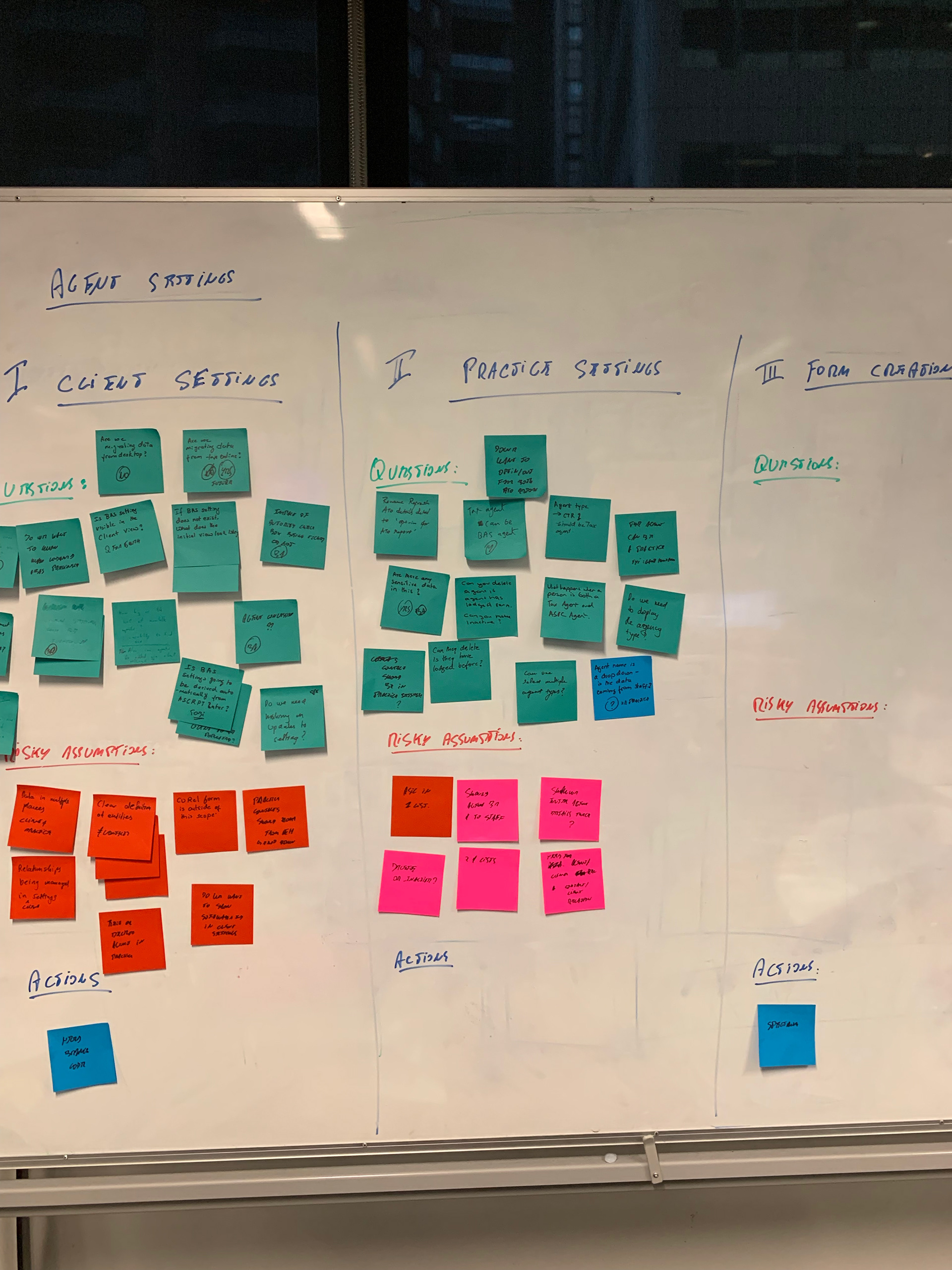

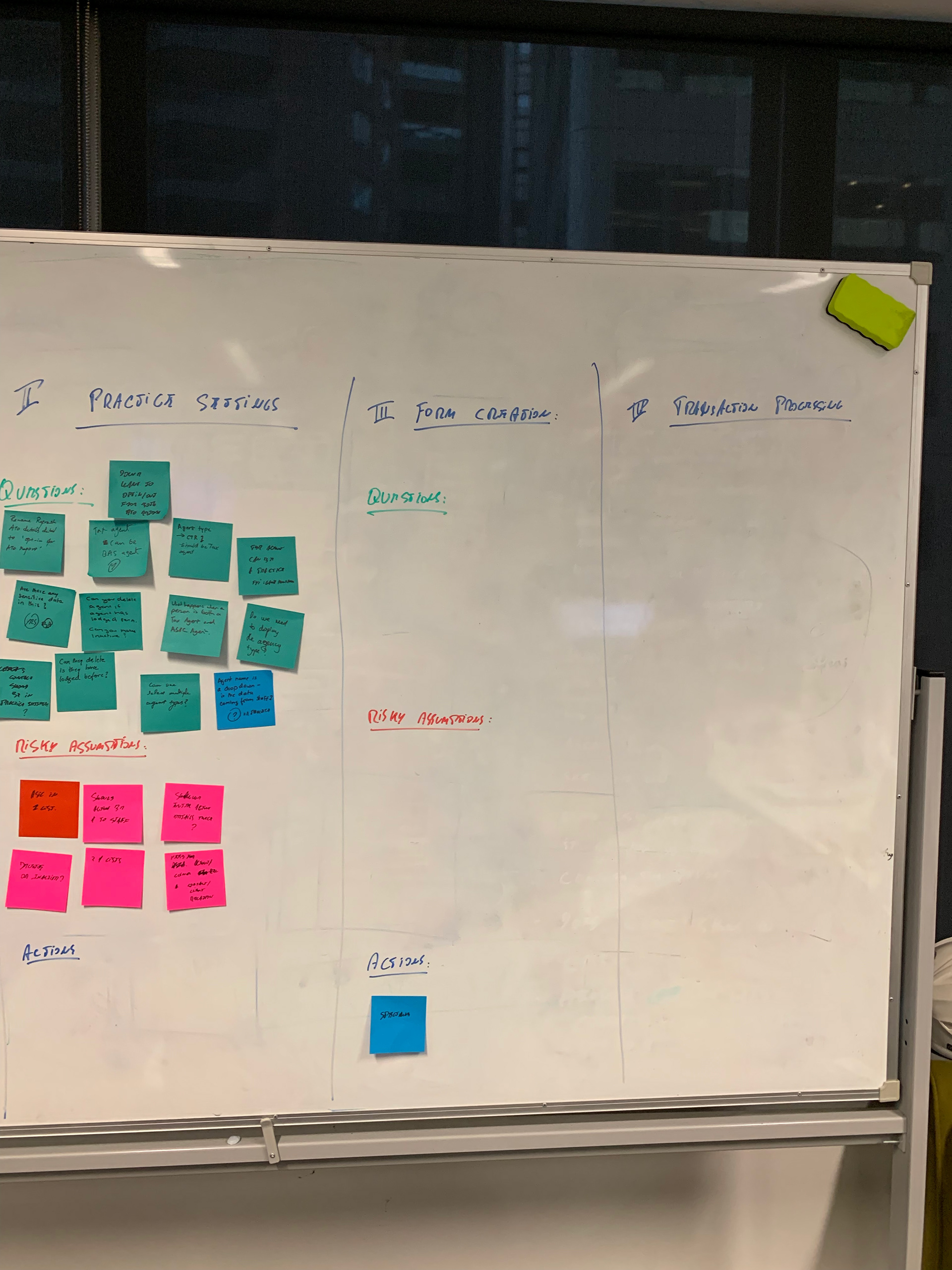

The first thing we did was a project ‘kick off’ with the BA, PM and key stakeholders in order to gather insights into the problem, have an understanding of the scope and identify any potentially risky assumptions.

I did several internal listening tours with MYOB accountants and members of the desktop team in order to gather knowledge of the subject and existing implementations.

What did we know?

• We knew that an agent was needed in order to lodge any tax form.

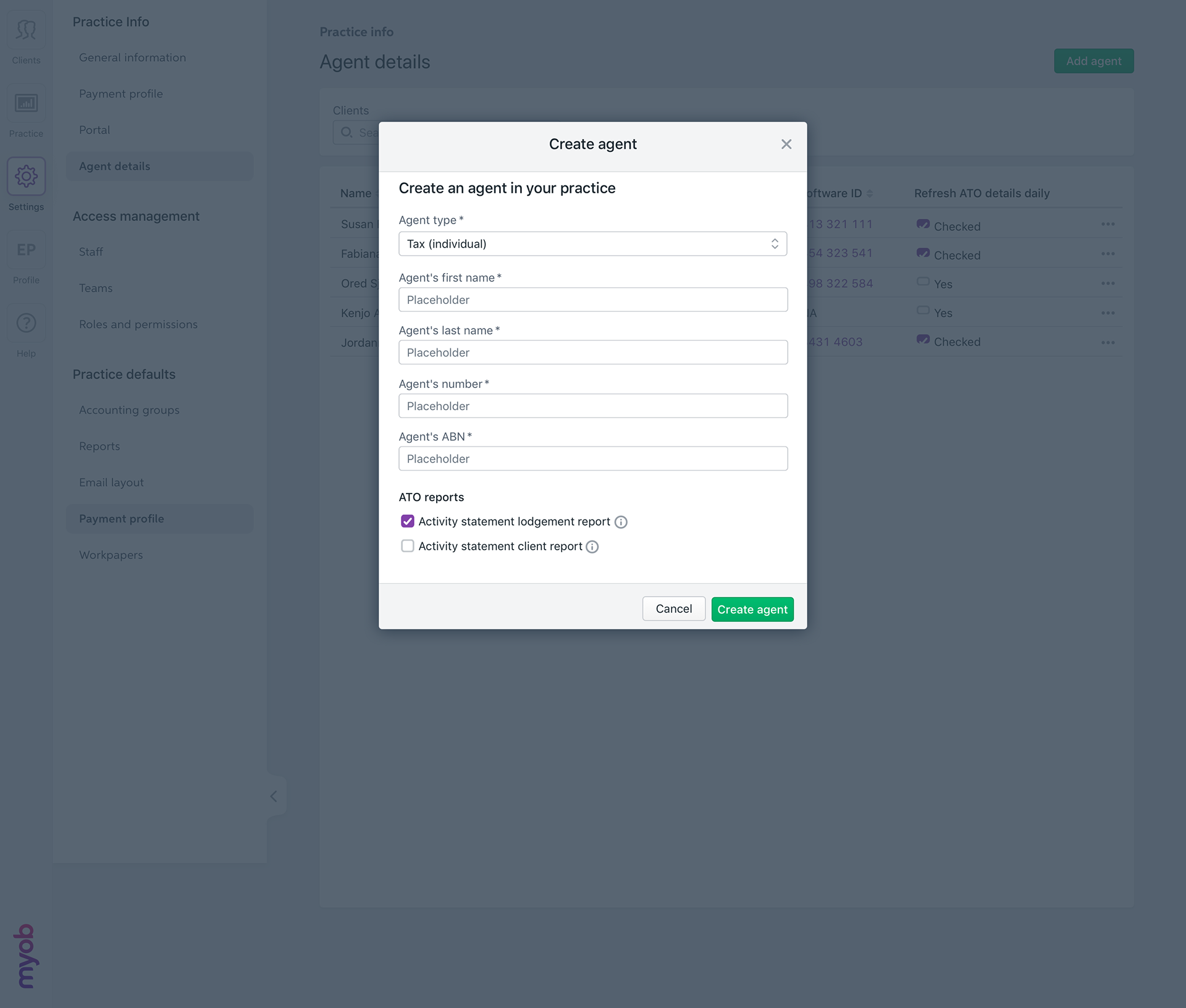

• The types of agents (Tax and BAS) and the type of information that was required from the users to create these profiles.

• An existing set of similar settings already exists in the desktop product.

• A certain level of agent settings (BAS) already exists in parts of the product.

• The types of agents (Tax and BAS) and the type of information that was required from the users to create these profiles.

• An existing set of similar settings already exists in the desktop product.

• A certain level of agent settings (BAS) already exists in parts of the product.

Our hypothesis

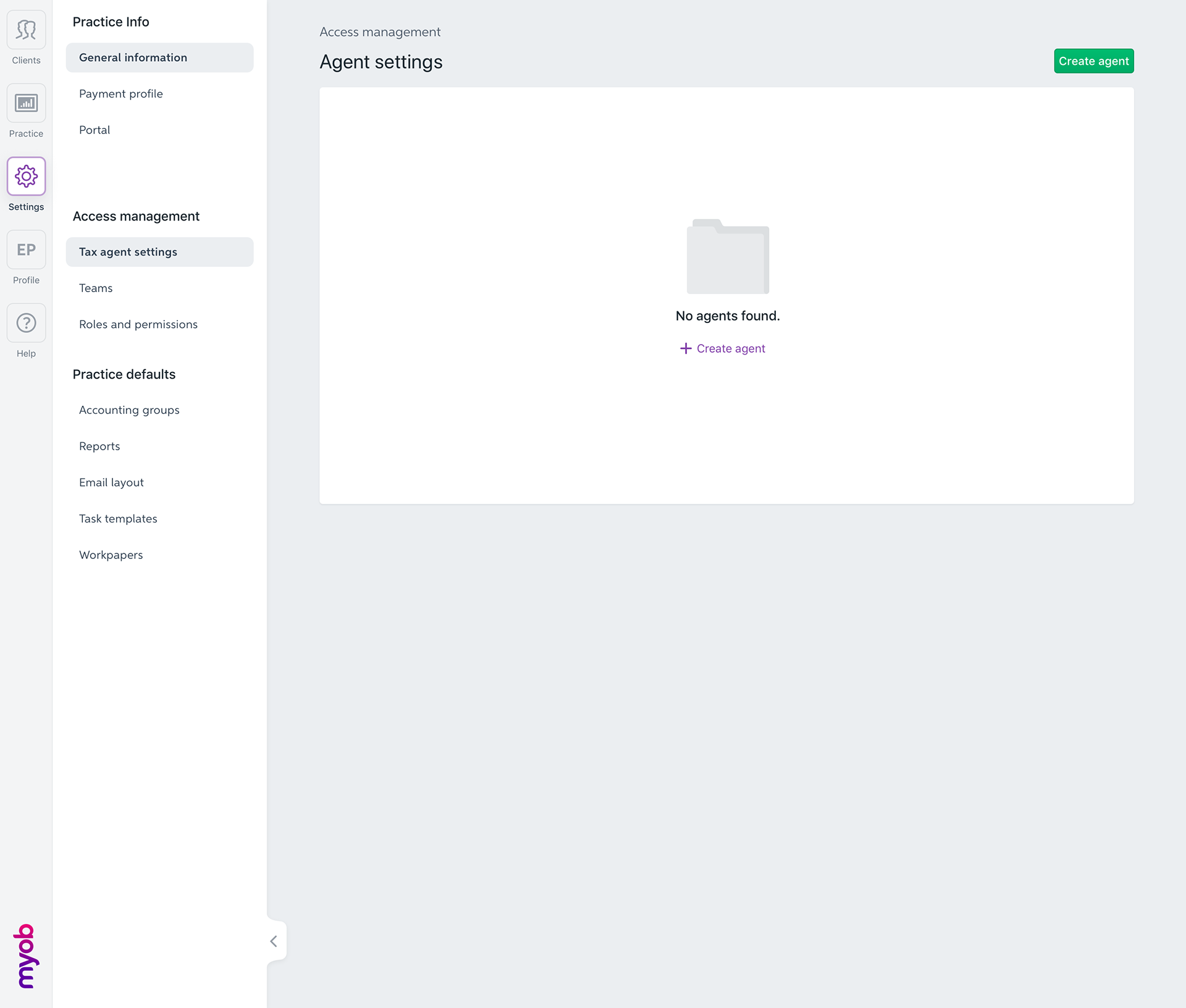

• Adding an agent settings section in the practice settings part of MYOB practice to allow users to manage agents.

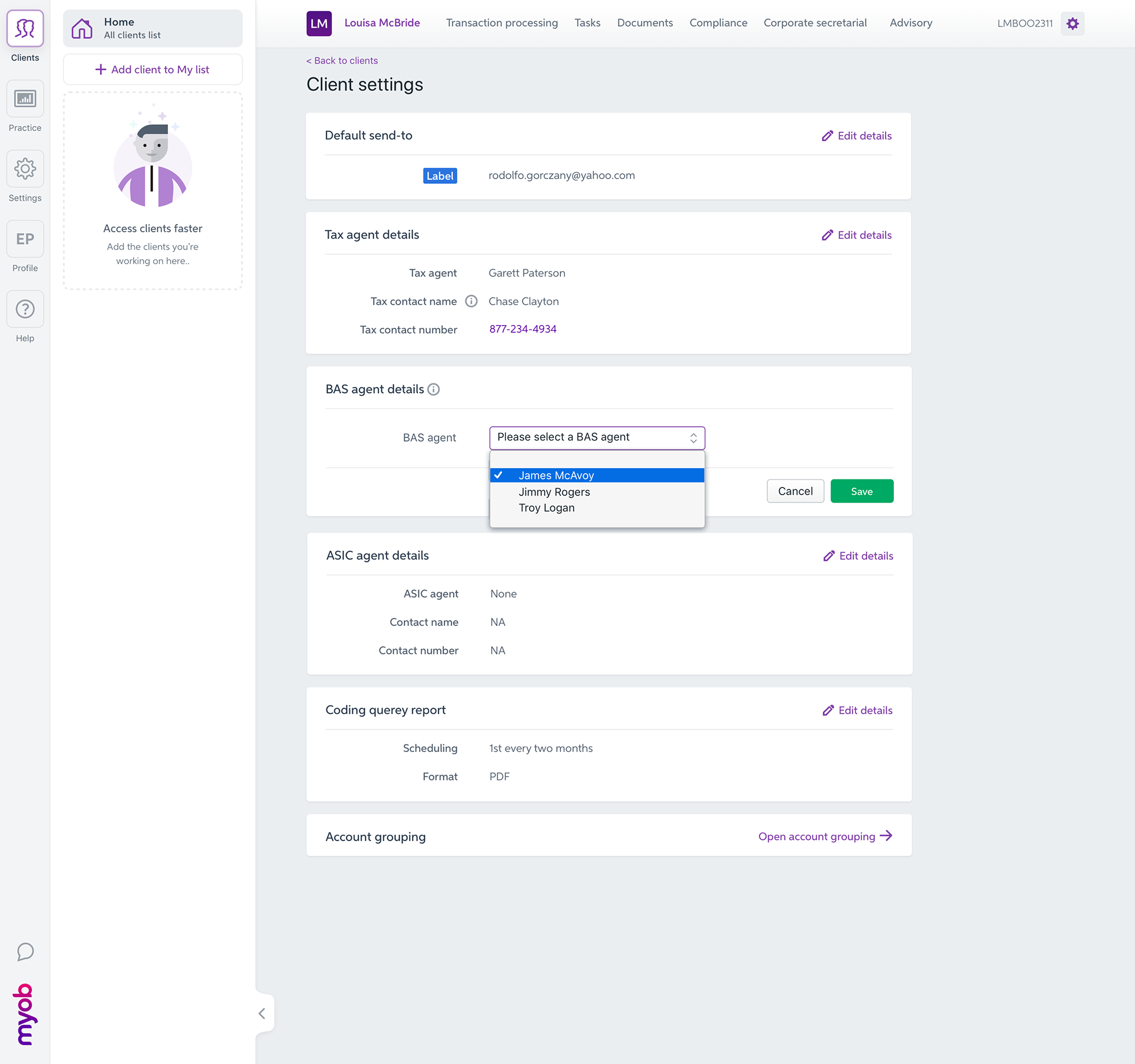

• Adding an agent setting section in the clients part of MYOB practice in order to maintain the relation between agent and client.

• Adding an agent setting section in the clients part of MYOB practice in order to maintain the relation between agent and client.

2.2 Define - the area to focus on

What we didn’t know and wanted to discover

• Where are users expecting to find and access this feature in our solution (MYOB practice) |

• What are the differences between a Tax and a BAS agent?

• Where does ASIC agent sit?

• Could we “make” an agent a default agent, and that agent will be used for all clients that have no linked agent?

Assumption: desktop does it the same way

• Are users expect to roll over the settings from the current BAS implementation?

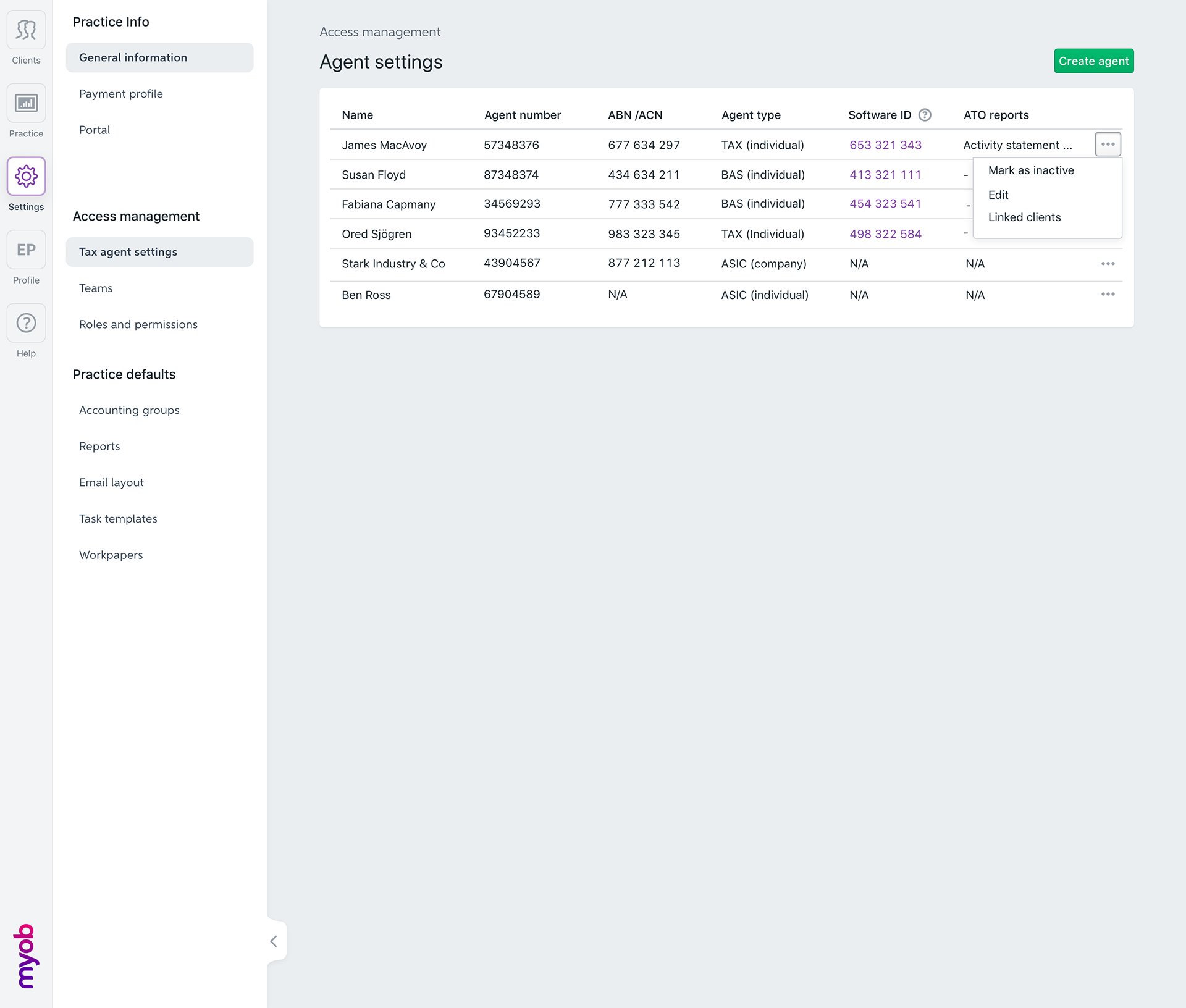

• At the practice level: we just want to list the list of all the agent

At a client level we indicate the relation between the agent and the client

Risky assumption: users want to create it individually each relations

Assumption: desktop does it the same way

• If an agent doesn’t exist as part of the list, we need to be able to create an agent“on the fly” when creating a form manually?

• What ATO reports are users expect to use and how?

• If agent is deleted, 14 client have no longer a tax agent, what do we do?

• What level of information is expected to be seen in association with agents?

• Where does ASIC agent sit?

• Could we “make” an agent a default agent, and that agent will be used for all clients that have no linked agent?

Assumption: desktop does it the same way

• Are users expect to roll over the settings from the current BAS implementation?

• At the practice level: we just want to list the list of all the agent

At a client level we indicate the relation between the agent and the client

Risky assumption: users want to create it individually each relations

Assumption: desktop does it the same way

• If an agent doesn’t exist as part of the list, we need to be able to create an agent“on the fly” when creating a form manually?

• What ATO reports are users expect to use and how?

• If agent is deleted, 14 client have no longer a tax agent, what do we do?

• What level of information is expected to be seen in association with agents?

2.3 Develop - potential solution

To answer most of the questions above and what we identified as the risky assumptions, we agreed, with PM and BA, to run 6 usability tests and cover these points through 4 usability tasks and targeted questions.

The timeframes also didn’t really allow us to run any discovery interviews, so we had to jump into usability test relatively quickly with a first cut of the solution.

What was tested?

• Creating / Adding an agent to a practice in MYOB Practice

• Indicating a member of the staff is no longer an active agent in the practice

• Assigning an agent to a specific client

• When lodging a form, no agents are detected, what are the consequences and expectations?

• Assigning an agent to a specific client

• When lodging a form, no agents are detected, what are the consequences and expectations?

Usability testing

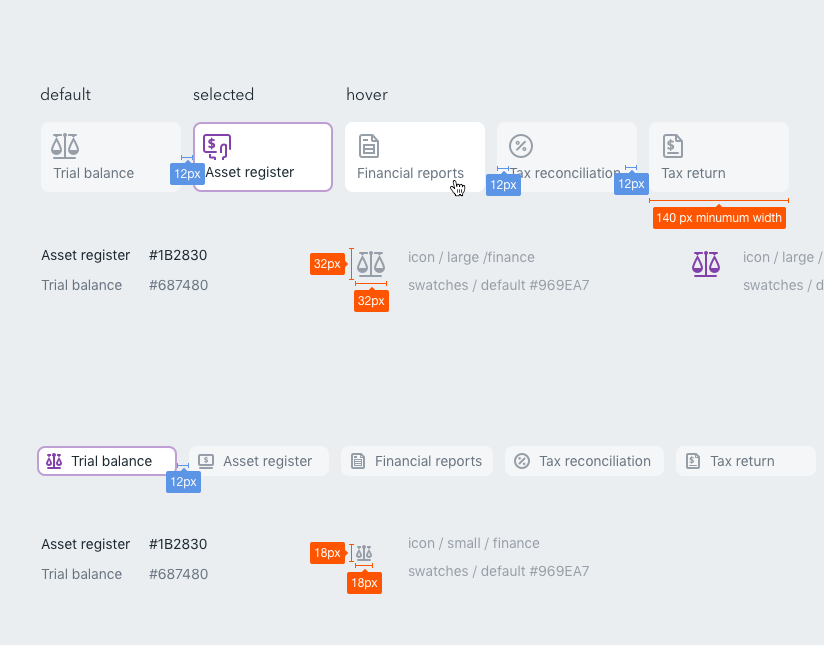

• Semi interactive prototypes (done in Sketch and Invision) that allowed testers to perform specific tasks

• High fidelity prototypes (we don’t really do many low fidelity prototypes at MYOB once we go to user testing)

• Interview guide

• Interactive prototype

• Interview guide

• Interactive prototype

What was the result? Highlights?

• Overall user test was a bit mixed as half the users failed to pass two of the tasks successfully.

But we felt like we were on the right track based on the insights.

But we felt like we were on the right track based on the insights.

• All testers identified the 2 levels of settings; one being practice related, where users can maintain and edit Tax/Bas agent, but also ASIC agents.

The other one being client related, where users can link, or associate these agents with a client

The other one being client related, where users can link, or associate these agents with a client

• We discovered a strong relation between staff and agents, as an agent has to be a member of your staff first, this has been identified as the cause of failure of the first task, as testers did expect to nominate an agent (BAS, Tax or ASIC) when creating a staff member in MYOB practice.

• We discovered that this level of setting is something users only do once, when the practice is set up and there are very few changes. The Tax agent is usually the partner or the manager of the practice and all accountants lodge on their behalf.

• Users’ expectation is that all agents, Tax, BAS but also ASIC should be available from the same place.

• We discovered a TAX agent can lodge all compliance forms, but BAS agents can only lodge BAS forms. If there is a Tax agent, a BAS agent is not necessarily needed. It usually depends on the size of the practice, larger practices have more staff and diversified roles while smaller practices are a bit ‘Jack of all trades’.

• We discovered that a practice would never ‘delete’ an agent because of traceability and auditing reasons.

They want the ability to make them inactive. Once more, it is a very rare occurrence but it happens.

They want the ability to make them inactive. Once more, it is a very rare occurrence but it happens.

• Making an agent the ‘default agent’ is not making sense as all relations client/agent need to be notified to the ATO through a CU form (customer upgrade).

This was one of the risky assumptions, if there is not agent associated with a client, use the default agent.

This would result in the lodged forms being rejected by the ATO

This was one of the risky assumptions, if there is not agent associated with a client, use the default agent.

This would result in the lodged forms being rejected by the ATO

• We discovered that users are expecting to see the clients / agent relations in the agent settings section and not having to go and check one by one in the client’s detail.

• User also expect to be able to manage the client / agent relation in one place (agent settings) when an agent is made inactive, and again, not having to do it one by one in the client detail sections.

• We also discovered the importance of the ATO reports. We only had a limited understanding of the ATO reports and what they did and this round of user testing gave us a lot more informations on the user expectations.

This wasn’t strictly part of this feature but we discovered it is intimately linked and has had an impact on the product road map for the rest of the year.

This wasn’t strictly part of this feature but we discovered it is intimately linked and has had an impact on the product road map for the rest of the year.

We are currently working at integrating some of the ATO reports in the agent settings workflow.

"You need to be a staff member before you can be an agent"

Carly

Carly

"Not all staff members are agents"

Belinda

Belinda

2.4 Deliver - A solution that works

What did I deliver:

What did I deliver:

The findings of the round of user testing was presented to the key stakeholders in a meeting.

Based on these insights, we agreed on the first version of agent settings and what needed to be released for the users to be able to achieve their primary goals.

This was a combined effort with the development team, BA and PM.

Based on these insights, we agreed on the first version of agent settings and what needed to be released for the users to be able to achieve their primary goals.

This was a combined effort with the development team, BA and PM.

I iterated on the designs and delivered a set of interactive prototypes that covered all the use cases we agreed to deliver for the first cut of this feature.

I worked closely with the Customer Experience team to create and review the copy across the entire delivery.

Some trade offs were made and we had to make some compromises that went against the users’ feedback that we uncovered during the user testings.

What were they?

• Despite users expecting this level of settings to be part of staff section, we decided to create an agent settings section.

Why? The client sections of MYOB practice being managed by another department, we had to move with an acceptable solution and ship this feature in order not to block our roadmap.

This will be added to the client section at a later date

Why? The client sections of MYOB practice being managed by another department, we had to move with an acceptable solution and ship this feature in order not to block our roadmap.

This will be added to the client section at a later date

• Managing the agent / client relations in that section couldn’t be achieve in the first version, as it did blow the development available time.

This will be addressed at a later date.

This will be addressed at a later date.

• All ATO reports integration has been removed from this scope as we uncovered through the user testing that it was a much larger piece than we originally anticipated.

Will be addressed later on this year.

Will be addressed later on this year.

• CU forms or customer update form. All these levels of settings are only valid of they are communicated to the ATO through a Customer Update form (CU form). When relevant, we are notifying the user when they need to engage with the ATO portal.

We will integrate the CU forms at a later date.

We will integrate the CU forms at a later date.

3. In conclusion

Outcomes and results:

• Overall this was a very successful project.

I didn’t know anything about agent settings and nor did the dev team I was supporting.

I didn’t know anything about agent settings and nor did the dev team I was supporting.

Because I heavily involved them during the interview process; from the preparation, note taking during the user testing sessions and analysing the results, the team felt comfortable with the subject (understanding why we were building this feature) and all the trade offs where decisions made as a group.

• As a result of that highly collaborative effort, the development went very well, the team reached out when needed and the outcome of what was developed was a very close match with the design delivery.

• The relationship between UX and that development crew wasn’t the best before we entered this project and we have since then had 2 retros and the relationship between UX / dev has dramatically improved.

• The feature is now in product and we are currently working at delivering what we didn’t have the opportunity to develop during the first phase of this project (focus being on improving the agent / client relation management and ATO reports integration) .